7 Landmarks Saved by the Historic Tax Credit

The GOP’s tax reform bill has put the federal historic tax credit on the chopping block. Here are just a few of the buildings it helped revive since 1978.

Preservationists are fighting to save the decades-old federal Historic Tax Credit program, which was eliminated from the tax reform bill introduced in the House of Representatives on November 2. The program offers a 20 percent tax credit to developers who restore historic buildings in compliance with federal rehabilitation standards. Without that incentive, preservationists fear that developers will shy away from rehabs, which can be more costly and complicated than building new. Instead of being reused, more historic structures could sit empty or be demolished.

Chicago developer Ghian Foreman told Blair Kamin of the Chicago Tribune that the credit was essential to him. “Absent the federal historic tax credit, all of these buildings would need to be torn down,” he said, referring to the older structures in his portfolio. A commercial real-estate broker in New Orleans said the end of the credit would have “severe consequences” for that city.

The National Trust for Historic Preservation estimates that, since its inception in 1978, the credit has spurred more than $131 billion in private investment and helped preserve some 42,000 historic buildings—many in communities that could use a jolt of investment: According to a report by the National Park Service and Rutgers University, more than half of the credit-using projects in fiscal year 2016 were located in low- and moderate-income Census tracts.

The GOP’s tax cuts “will result in increased rates of [private] investment, including in rehabilitation and renovation of historic properties,” a spokesperson for House Majority Whip Rep. Steve Scalise told the New Orleans Times-Picayune. But according to the National Trust and Rutgers, the credit is a net benefit to the U.S. Treasury, bringing in about $1.20 for every dollar spent.

Cities have a high concentration of old buildings, so they would be heavily affected by the demise of the credit. (Not that small towns would be spared: 40 percent of the projects that used the credit over the past 15 years were in towns of fewer than 25,000 people.) The loss might be hardest for “legacy cities,” where historic rehabs have been a crucial factor in economic recovery. John Gallagher of the Detroit Free Press calls the House tax plan “a direct attack on cities like Detroit.”

Because the credit has been available for almost 40 years, it’s easy to take for granted how much it has influenced the development of American cities in that time. Here are seven important buildings that owe their longevity, at least in part, to federal historic tax credits.

1. Apollo Theater, New York City

Built in 1913 as an all-white burlesque theater and re-opened as a black-oriented theater in 1934, Harlem’s Apollo has become a world-famous showcase of African-American talent. In 2006, the theater’s owners used tax credits for a rehabilitation project that included restoring the exterior and marquee and expanding the lobby.

2. Wrigley Building, Chicago

One of Chicago’s most recognizable buildings, the Spanish-inspired wedding cake on the Magnificent Mile was built by chewing-gum tycoon William Wrigley Jr. in the early 1920s. Its $70 million renovation in 2012 made use of federal historic tax credits.

3. Ford Motor Company Assembly Plant, Richmond, California

Designed by renowned industrial architect Albert Kahn, Ford’s quarter-mile-long Richmond plant was the largest auto-assembly facility on the West Coast when it opened in 1930. During World War II, its workforce—swelled by many women—made tanks, jeeps, and other military vehicles. The factory closed in 1953 and the City of Richmond eventually sold it to Orton Development, which used tax credits for a $55 million rehabilitation beginning in 2004. The plant is now part of the Rosie the Riveter WWII Home Front National Historic Park and hosts a private event venue and various businesses.

4. Fontainebleau Hotel, Miami Beach

The curving white slab of the Fontainebleau, designed by Morris Lapidus, was the last word in glamour in the 1950s and 1960s—a set in the movie Goldfinger and a Rat Pack hangout. It was renovated and expanded from 2005 to 2008 at a cost of $1 billion, the largest project in Florida to utilize federal historic tax credits. (The credits cannot be applied to new additions, but $317 million in rehabilitation work was eligible.)

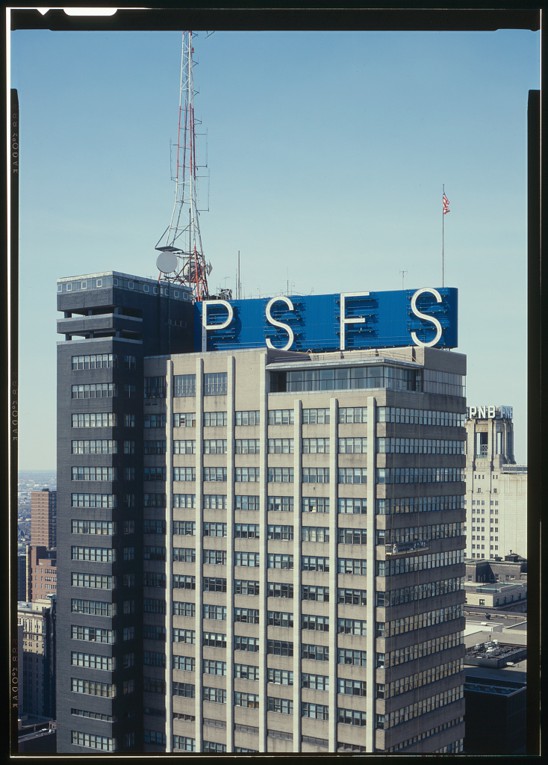

5. PSFS Building, Philadelphia

The 27-foot-high neon letters “PSFS” have glowed on the Philly skyline since this tower, originally the home of the Philadelphia Saving Fund Society, opened in 1932. One of the country’s first modern skyscrapers, it was converted with $115 million and tax credits to the Loews Philadelphia Hotel in 2000.

6. Ponce City Market, Atlanta

The $250 million transformation of this former Sears, Roebuck and Co. warehouse into a mixed-use development is one of the biggest-ever federal historic tax credit projects. The 2.1-million-square-foot building in the city’s Old Fourth Ward is now a mixed-use development with offices, apartments, stores, and a food hall.

Writing before its completion in 2014, preservationist Donovan Rypkema noted that “Ponce City Market has spurred development in the surrounding area. Two years prior to the acquisition of the Sears Building, a total of two building permits were issued in the neighborhood. Two years after there were 38 building permits. Importantly for an inner-city neighborhood, 8 times as many building permits were issued for alteration, conversion, and repair as for demolition.”

Twenty percent of Ponce City Market’s apartments are reduced-rent. Nevertheless, housing costs in the area have surged with the arrival of the BeltLine trail and a wave of development.

7. Old Post Office, Washington, D.C.

That’s right: After he took possession of the 1899 Old Post Office, which he leases from the federal government in an unusual (and controversial) public-private partnership, Donald Trump turned it into a luxury hotel and the Trump Organization received a $40 million tax credit. Good thing they claimed it in time, I guess.

Comments

Post a Comment